Rmd Changes For 2025. Changes to required minimum distributions (rmds): Required minimum distributions (rmds) are minimum amounts you must withdraw from your ira or retirement plan account when you reach age 72.

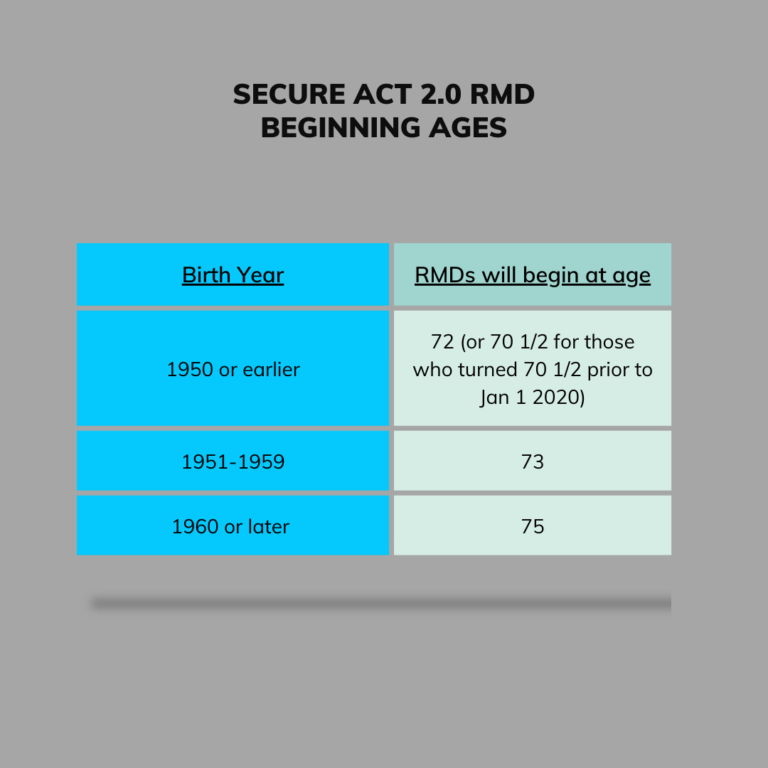

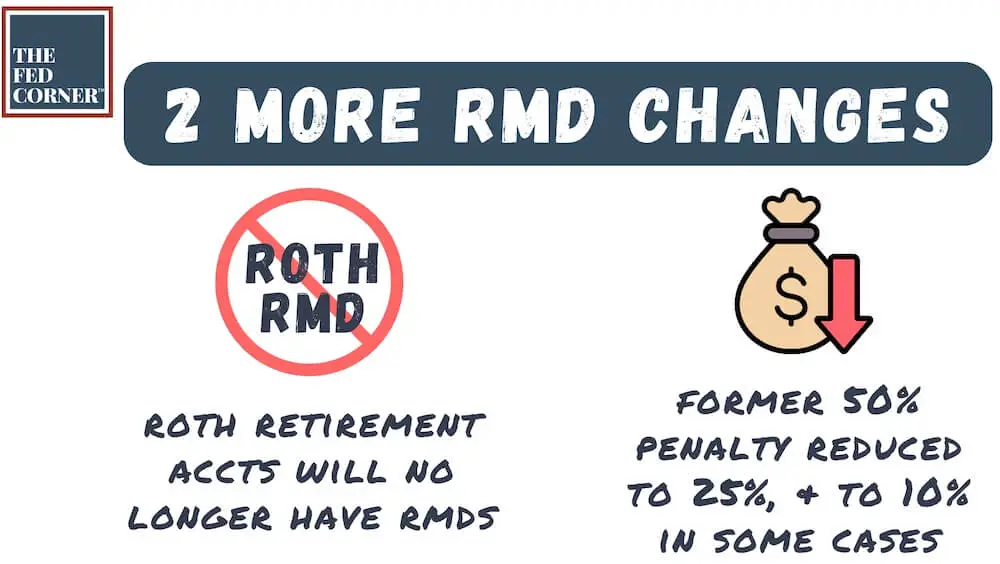

The secure act 2.0 brings more major changes to tax law and retirement plans, including steps toward ‘rothification’ through expanded use, new requirements,. Starting age, penalties, roth 401 (k)s, and more.

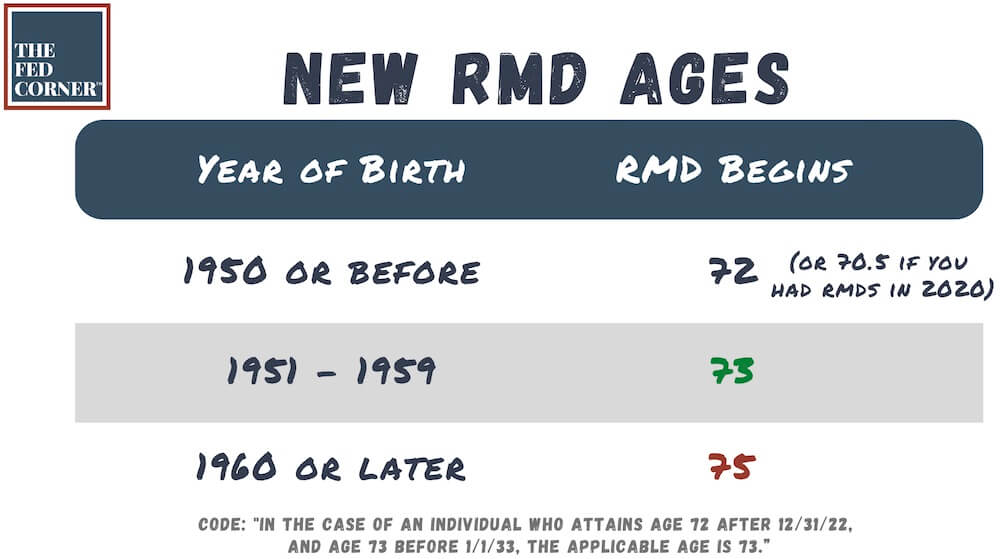

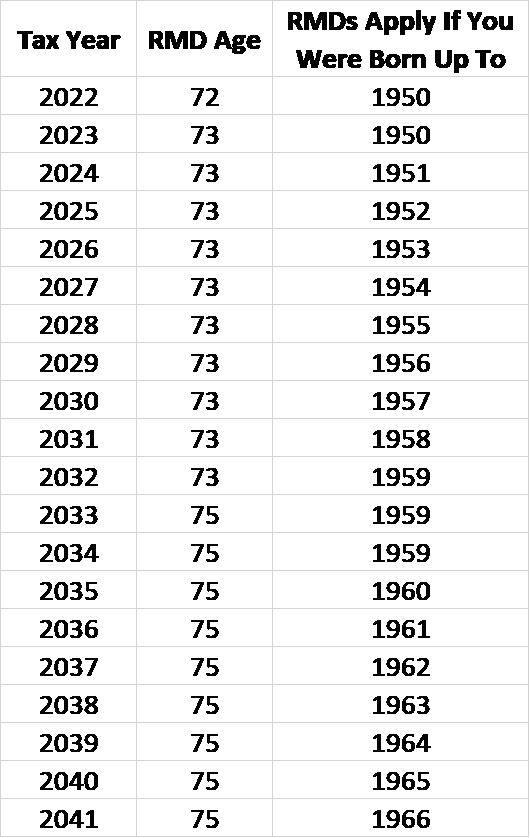

The secure 2.0 act has made significant changes, including raising the rmd starting age to 73 in 2025.

Massive Changes To RMDs What Federal Retirees Need To Know, An account holder turns 73 in 2025. For 2025, the irs allows seniors age 70 1/2 or older to make a qcd of up to $105,000 from their ira.

The SECURE Act 2.0 RMD Changes & Impact on Your Retirement Savings, The irs is again delaying the implementation of ira rmd final rules, this time until 2025. For 2025, the irs allows seniors age 70 1/2 or older to make a qcd of up to $105,000 from their ira.

What are the rules for Required Minimum Distributions? Imagine, An account holder turns 73 in 2025. Required minimum distributions begin at 73, but you can choose to delay your first distribution.

SECURE Act’s Increase in RMD to Age 72 May Lead to Avoidance of Net, Those born in 1951 turn 73 in 2025; The irs is again delaying the implementation of ira rmd final rules, this time until 2025.

Secure Act required minimum distribution, RMD age of 7012 Financial, The secure 2.0 act has made significant changes, including raising the rmd starting age to 73 in 2025. As the 2025 rmd calculation is based on the account value as of december.

Massive Changes To RMDs What Federal Retirees Need To Know, Plus review your projected rmds over 10 years and over your lifetime. Below is an example of the rmd process in action.

SECURE Act RMD Changes YouTube, The best part is that qcds count toward your required minimum distributions. The rmd table the irs provides can help you figure out how much you should be withdrawing.

Massive Changes To RMDs What Federal Retirees Need To Know, The rmd age increases to age 73. The 2017 tax cuts and jobs act brought sweeping changes to the tax code,.

Retirement Changes in SECURE Act 2.0, The best part is that qcds count toward your required minimum distributions. The change in required minimum distribution (rmd) age from iras and qualified employer sponsored retirement plans (qrp) such as 401 (k), 403 (b), and governmental 457 (b).

Massive RMD Changes From Secure Act 2.0 Explained Required Minimum, The best part is that qcds count toward your required minimum distributions. As the 2025 rmd calculation is based on the account value as of december.

Rmd Changes For 2025. Changes to required minimum distributions (rmds): Required minimum distributions (rmds) are minimum amounts you must withdraw from your ira or retirement plan account when you reach age 72. The secure act 2.0 brings more major changes to tax law and retirement plans, including steps toward ‘rothification’ through expanded use, new requirements,.…